MCLEAN, Va. - Hilton Worldwide Holdings Inc. ("Hilton" or the "Company") (NYSE: HLT) today reported its third quarter 2017 results. All results herein present the performance of Hilton giving effect to the spin-offs of Park Hotels & Resorts Inc. ("Park") and Hilton Grand Vacations Inc. ("HGV") on January 3, 2017 (the "spin-offs"), with the historical financial results of Park and HGV reflected as discontinued operations. Additionally, all share and share-related information presented herein for periods prior to January 3, 2017 have been retrospectively adjusted to reflect the 1-for-3 reverse stock split of Hilton's outstanding common stock that occurred on January 3, 2017 (the "Reverse Stock Split"). Highlights include:

-

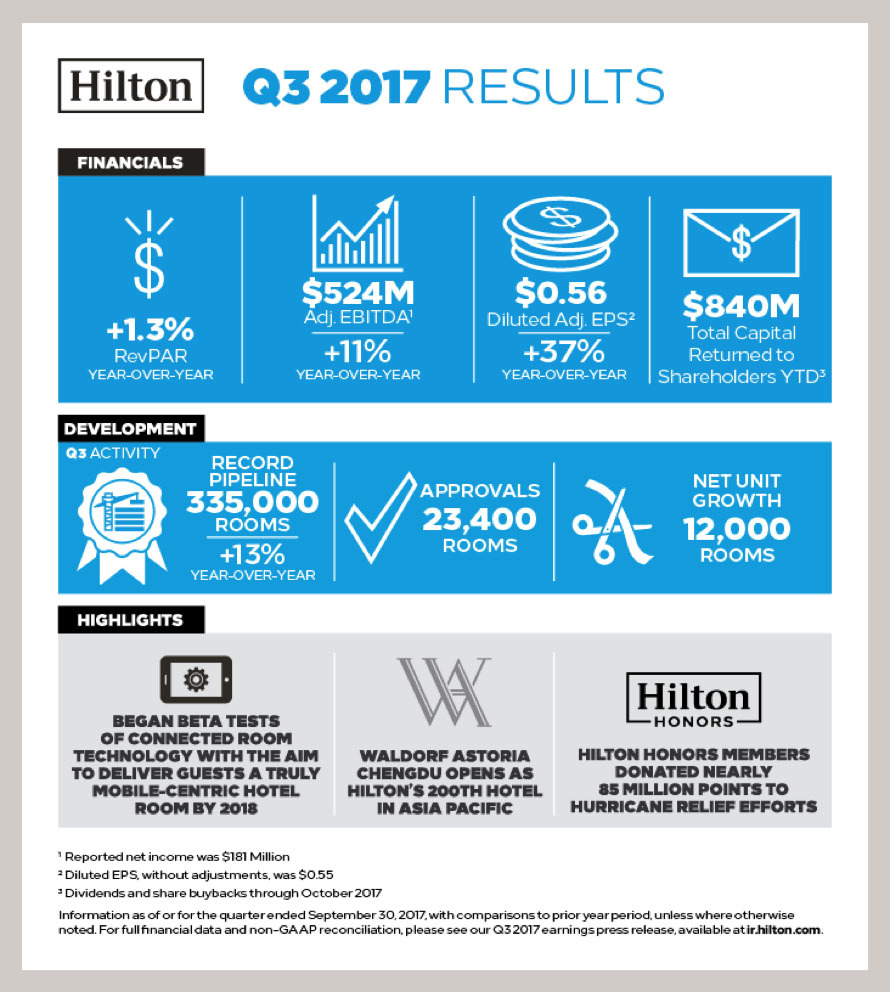

Diluted EPS for the third quarter was $0.55 and diluted EPS, adjusted for special items, was $0.56, an increase of 37 percent from the third quarter of 2016 on a pro forma basis

-

Net income for the third quarter was $181 million

-

Adjusted EBITDA for the third quarter was $524 million, an increase of 11 percent from pro forma Adjusted EBITDA for the third quarter of 2016

-

Adjusted EBITDA margin was 56.9 percent, an increase of 170 basis points from pro forma Adjusted EBITDA margin for the third quarter of 2016

-

System-wide comparable RevPAR increased 1.3 percent on a currency neutral basis for the third quarter compared to the prior year

-

Added 12,000 net rooms in the third quarter

-

Approved 23,400 new rooms for development during the third quarter, growing Hilton's development pipeline to a record 335,000 rooms, representing 13 percent growth from September 30, 2016

-

Repurchased 4.3 million shares of Hilton common stock for an aggregate cost of $273 million during the third quarter, bringing total capital return year to date, including dividends, to approximately $840 million

-

Raised Adjusted EBITDA guidance for full year 2017 to between $1,920 million and $1,940 million, an increase of $30 million at the midpoint

-

Full year 2018 system-wide RevPAR is expected to increase between 1.0 percent and 3.0 percent on a comparable and currency neutral basis compared to 2017; net unit growth is expected to be approximately 6.5 percent

About Hilton

Hilton (NYSE: HLT) is a leading global hospitality company with a portfolio of 24 world-class brands comprising more than 8,400 properties and over 1.25 million rooms, in 140 countries and territories. Dedicated to fulfilling its founding vision to fill the earth with the light and warmth of hospitality, Hilton has welcomed over 3 billion guests in its more than 100-year history, was named the No. 1 World’s Best Workplace by Great Place to Work and Fortune and has been recognized as a global leader on the Dow Jones Sustainability Indices. Hilton has introduced industry-leading technology enhancements to improve the guest experience, including Digital Key Share, automated complimentary room upgrades and the ability to book confirmed connecting rooms. Through the award-winning guest loyalty program Hilton Honors, the more than 210 million Hilton Honors members who book directly with Hilton can earn Points for hotel stays and experiences money can't buy. With the free Hilton Honors app, guests can book their stay, select their room, check in, unlock their door with a Digital Key and check out, all from their smartphone. Visit stories.hilton.com for more information, and connect with Hilton on Facebook, X, LinkedIn, Instagram and YouTube.